So, you have a house you intend to flip… but where do you start? Knowing the answer to that question, and being able to properly execute a house flip, isn’t easy. Fear not! We’ve put our 20 years of experience into a quick guide to help novice flippers get started!

What is a Flip?

For a house to be considered a “flip,” the intention must be to resell the home quickly after purchase – typically within several months to a year. A house flip will either include renovating and repairing the home to increase its value before re-selling, or merely holding onto the property as home values rise in the area, then selling the home at a higher price.

Either option is a viable way to flip a home, but for this article we’ll primarily focus on tips and advice for flipping a home according to the first definition.

Finding the Right Market

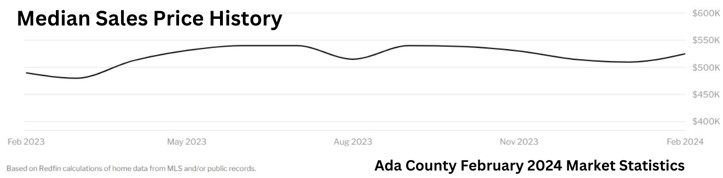

The first thing to do is find the right market to invest in. This doesn’t just mean picking the right city but the neighborhood, too. Getting a great deal on a home and renovating within your budget doesn’t necessarily mean you’re going to see an amazing return on investment (ROI).

The market in which you operate plays a significant role in what kind of profit to expect, and research shows a significant disparity between earnings in different regions. Below is a list of critical information to consider when seeking the best region in which to invest.

- High growth expectation over the next few years

- Homeownership rates from the previous one to two years

- Median household incomes

- Median household costs per month

- Rental vacancy rates

- Remodeling costs

Decide on a Budget

Once you have decided on the perfect market, the next step is building a budget. First, decide how much house you can afford – but don’t forget to consider renovation, repair, and tax costs for the house. If you are not paying for the house in cash, you will also need to consider mortgage applications and ongoing interest payments. We recommend buying with cash if possible, as it allows you to mitigate investment risk, sidestep the aforementioned inconveniences, and makes you more attractive to sellers when picking a fix-and-flip home.

Once you’ve hammered out your budget, you also need to reflect on the market. It’s easy to forget this step, but it is critical you research and prepare for potential market fluctuations.

When considering how much you will be able to get for the house once everything is complete, aim for the lower end of the market to give yourself more overhead should your renovations go over budget.

Example: Houses in the neighborhood you decided on price out at $700,000. You pay $450,000 for the house, but you know you’ll need to renovate the kitchen and office, along with several other repairs, before you flip the home. You will want to carefully consider how much you invest in remodeling and repairs while also considering how the market will behave in the neighborhood, as expensive remodeling could begin to seriously eat into your profit margin on the house.

Establish a Timeline

With the property selected, and an inventory of the work required to flip the home; the next step is to determine a timeline. Each property will require different work, different costs, and therefore different timelines to complete. It could be six months, it could be six weeks – either way, be sure to give yourself ample leeway for inspections to be carried out and obstacles that might arise. This is especially important if you’ll be paying interest on the property while you’re completing projects.

Hire Trusted Contractors

Unless you plan to handle all the renovations and repairs yourself, hiring efficient, trusted contractors is key to quick turnaround and results that will wow potential buyers. Whether the contractor you hire works solo or uses a team, check their licenses and references. The re-salability of your home rests on the quality of these remodels, repairs, and inspection projects. Lastly, be sure the quotes line up with the budget you have decided upon, and the job can be completed within the determined timeline.

Selling the Property

Even if you decided to initially buy the house on your own, you will still want the help of a professional to sell it quickly and at the best price. Chose a realtor who can give you a reliable value of the property after repairs, and who knows the market you are buying and selling in. Realtors who have experience with home flippers also know how to market a home to emphasize the work that has been put into the property. Pick realtors who can sell flips at or near the top of the neighborhood market, and who have experience with the tax laws, paperwork, and timelines that come with flipping homes.

Bottom Line, Top of Mind

Flipping a home comes down to efficiently guiding each step of the process to achieve the best ROI for the work you put into the property. While flipping homes can be profitable, there are pitfalls. Keep these tips in mind, stick to a tight budget (smaller is often better for those starting out), and don’t be afraid to reach out to a realtor for help – especially if you are a beginner.

Hard work, dedicated research, and experience go a long way in turning a fixer-upper into a highly lucrative property. If you are looking to get started flipping homes, 360 Real Estate Service offers consultation services covering every part of the process. We flip our client’s projects into profits. Contact us today for a house flipping consultation!